Humanoid robots are unlikely to deliver significant productivity gains or be disruptive to household routines within the next five years, due to major barriers in artificial intelligence (AI), data collection and inadequate regulatory frameworks, according to UBS.

Advertisement

“The ‘EV moment’ [for humanoid robotics] may not happen within five years,” Phyllis Wang, China industrials analyst at UBS Securities, said at a briefing on Monday. Wang defined an “EV moment” as the pivotal breakthrough when technological bottlenecks were resolved, enabling sales to leap from 1 million to 10 million units in a five-year span. She noted that the much-hyped humanoid robotics sector was not yet at this turning point.

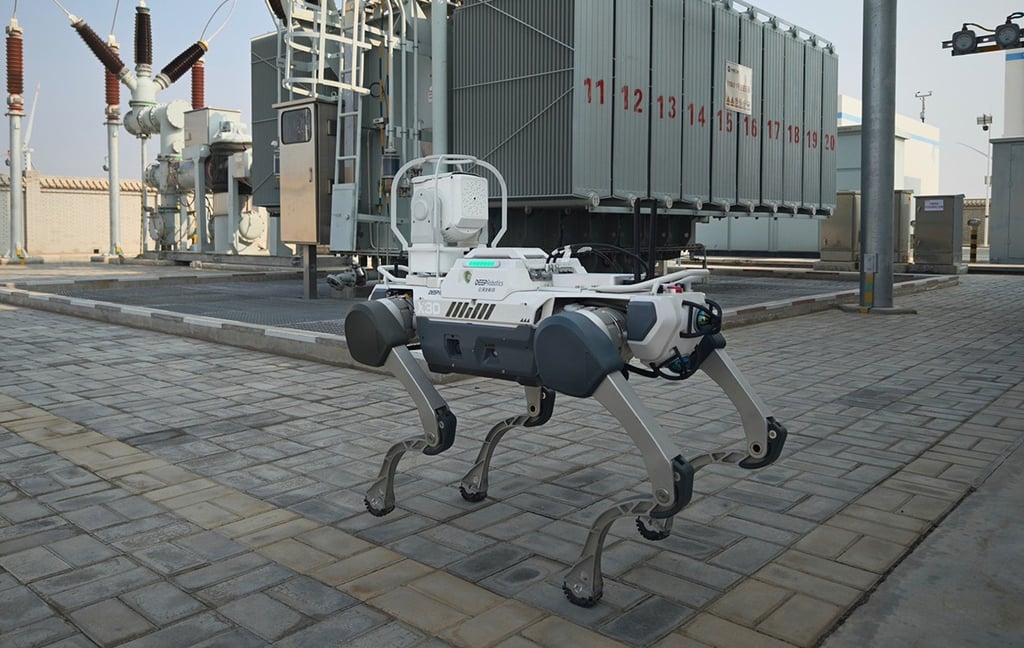

Despite near-term caution, Wang sees gradual progress, particularly in areas related to ageing societies, such as elderly care and labour shortages, as well as the reshaping of global manufacturing supply chains. UBS predicted that the global humanoid robot population would surpass 300 million by 2025, with annual demand reaching 86 million units and the market value of the industry chain ranging from US$1.4 trillion to US$1.7 trillion.

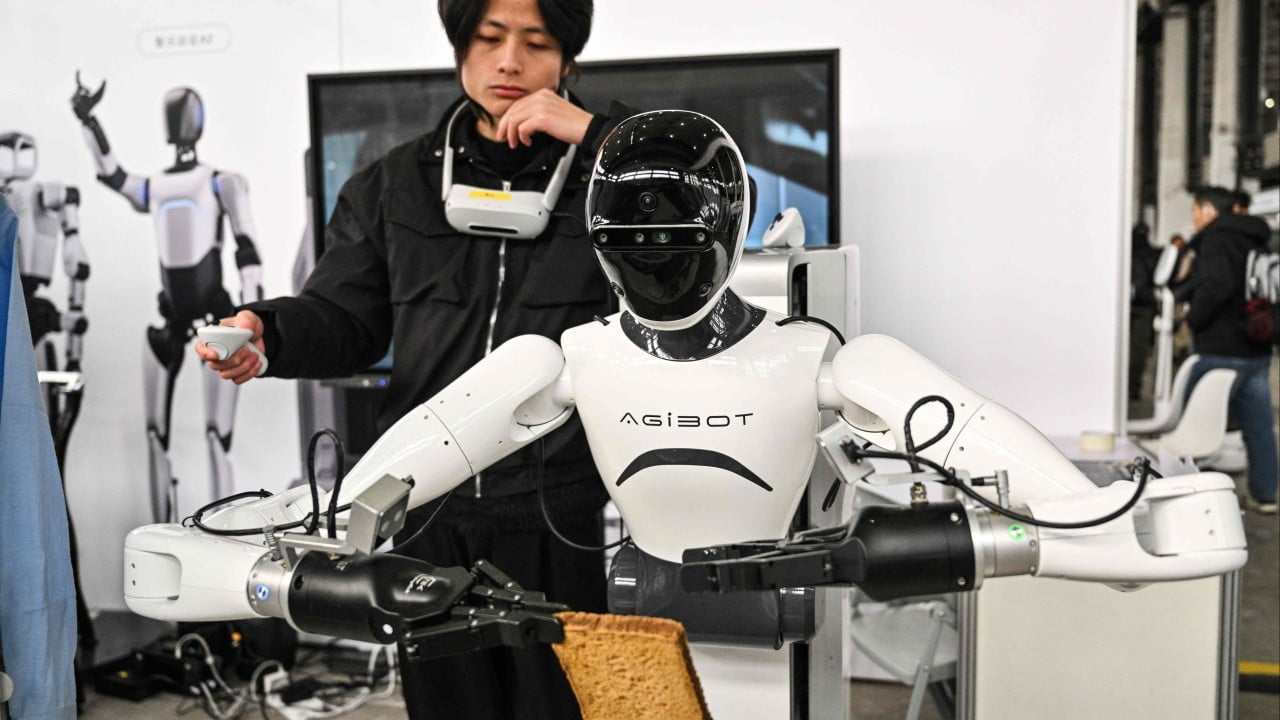

The humanoid robotics sector has been in the spotlight this year, notably after performances by Unitree Robotic’s dancing robots at China Central Television’s New Year’s Gala. Their presence at sports competitions, marathons and technology expos attracts wide attention.

Government policies have further accelerated this momentum. “Embodied intelligence” – the ability of robots to effectively interact with the physical environment – was mentioned by Premier Li Qiang in his March government work report. Major cities such as Shenzhen, Beijing and Shanghai have fast-tracked dedicated industry funds, injecting capital into the emerging sector.

Advertisement

According to UBS data, investments in humanoid robotics increased from just six deals worth US$63 million in 2022 to 40 deals totalling US$562 million last year.