When his health supplement business struggled with cash-flow problems, Bobby Tan* turned to a so-called professional networking group in Hong Kong for help, borrowing HK$300,000 (US$38,220) from a licensed small lender in April last year.

Advertisement

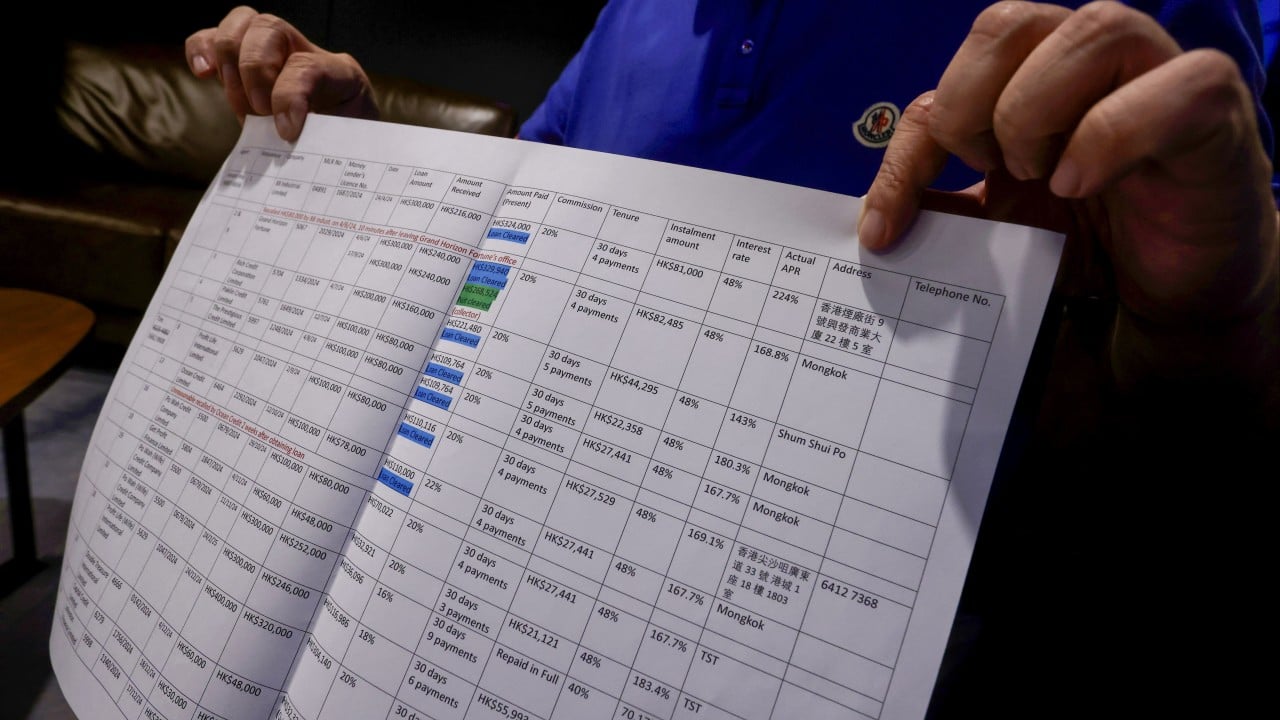

Over the next 10 months, the Hong Kong permanent resident from Southeast Asia continued to take on more debt, borrowing from 30 different licensed moneylenders for a total of HK$5.05 million.

Each lender charged him an illicit upfront “commission” of 15 to 30 per cent in addition to other expenses – effectively an interest rate of 1,031 per cent.

After deducting agents’ commissions, he only received HK$4.15 million in loans.

Having repaid more than HK$4.78 million, these lenders, who operate no differently from loan sharks, are still chasing Tan for HK$1.87 million.

Advertisement

When Tan overborrowed and was living in fear of being chased back for unpaid loans in December last year, the agents persuaded him to use his wife’s name, Alicia*, to borrow more.