Welcome to Open Dialogue, a new series from the Post where we bring together leading voices to discuss the stories and subjects occupying international headlines.

Advertisement

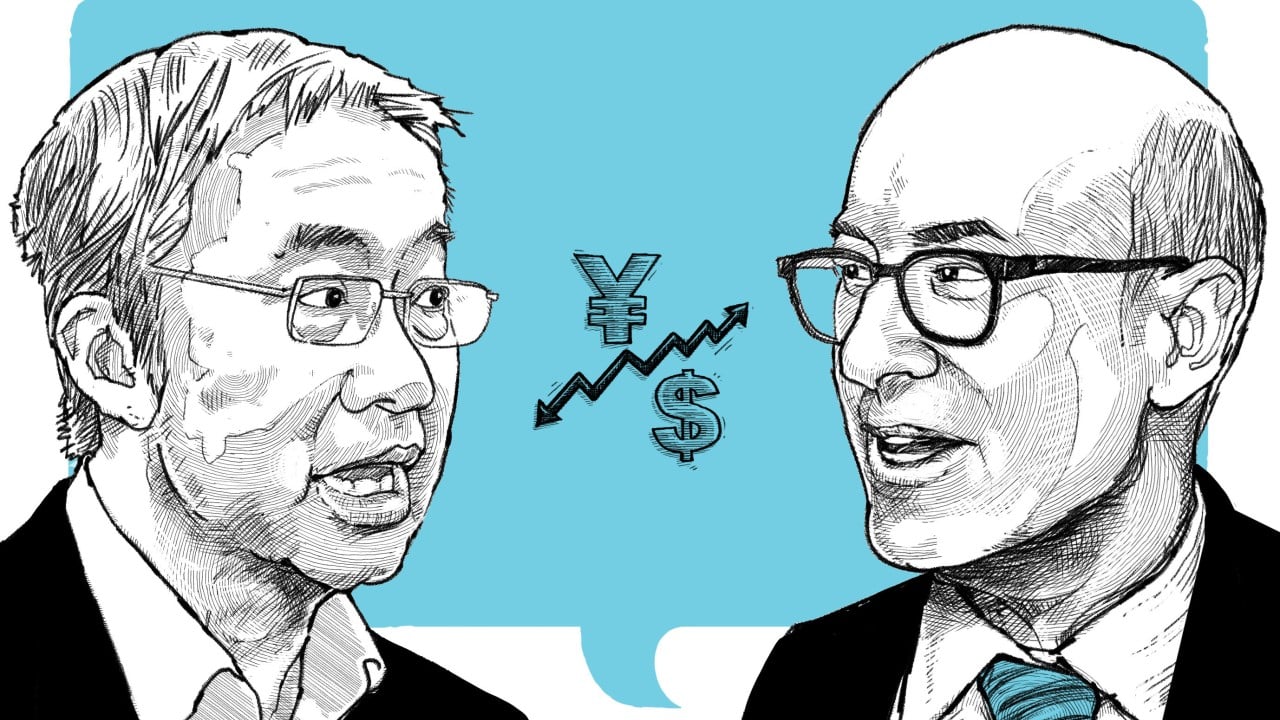

In this inaugural edition, we invited prominent economists from both sides of the Pacific to reflect on the recent turmoil in global trade, the diminishing role of the US dollar and whether China’s yuan could – or should – take its place.

Professor Kenneth Rogoff of Harvard University has repeatedly warned the US dollar is approaching a crisis of legitimacy. Having written extensively on the global recession in the late 2000s, Rogoff has turned his focus to the US currency’s now more unstable place at the top of the world’s financial hierarchy. A former chief economist of the International Monetary Fund – and a chess grandmaster – he published Our Dollar, Your Problem in early May.

Dr Yu Yongding has been outspoken in his advocacy of a free-floating yuan and broad fiscal stimulus in China. He has also recommended Beijing gradually reduce its holdings of US Treasuries to a level that minimises potential losses. Previously an adviser to China’s central bank, he remains an influential voice in policy circles as a senior fellow of the Beijing-based governmental think tank, the Chinese Academy of Social Sciences.

What do you think about the future of the US dollar? Will it remain the dominant global currency?

Advertisement

Yu Yongding: It can be asserted that foreign investors’ demand for US assets, particularly Treasury bonds, will gradually decline, making it increasingly difficult for the US to sustain its balance of payments and maintain a strong dollar.

The US dollar is the world’s most important reserve currency. Other countries around the world need to hold a certain amount of US dollars to pay for imports, service debts, intervene in foreign exchange markets and meet unexpected needs. The US dollar is primarily invested by its holders in highly liquid short-term US Treasury bonds. In essence, the dollar is essentially an “IOU” issued by the US government, backed by its own credit.