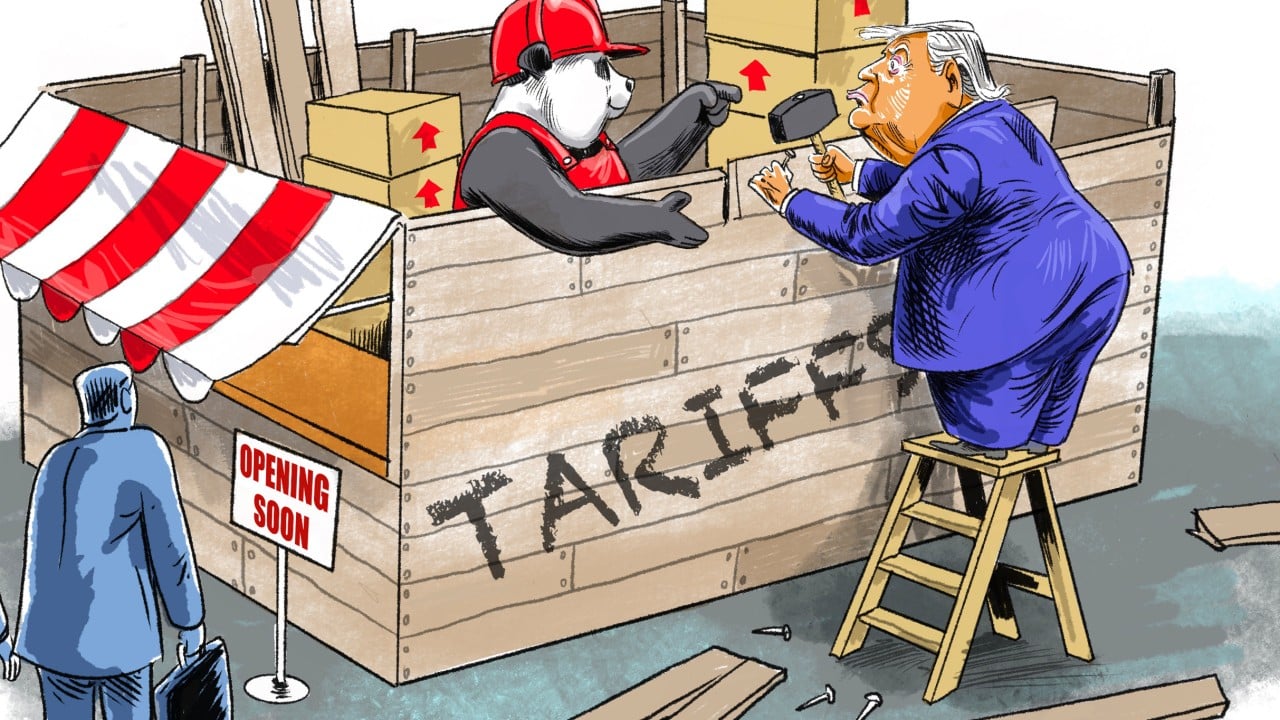

As the US-China trade war escalates, US President Donald Trump has temporarily exempted imports from other countries from the punitive tariffs he announced on April 2. He is reportedly trying to bully others into limiting their economic ties with China in exchange for a deal. Washington aims to isolate China, but the opposite is happening.

Advertisement

Since last year, a consensus has been built that weak domestic demand is the major drag on China’s economic growth. In September, Beijing implemented a package of countercyclical policies to fix the problem, seeking to boost domestic demand with a particular focus on consumption.

Trump’s tariffs have further enhanced China’s determination to reduce dependence on the US market and embark on the path of building itself into a large consumer market.

China has a robust toolbox at its disposal for this purpose. It includes a range of fiscal and monetary policies, with fiscal policy taking the lead.

China’s fiscal move has two key parts. First, a 10 trillion yuan (US$1.3 trillion) debt swap plan was announced to help local governments deal with hidden debt, contributing to transparent debt management. The measure reduces interest rates by around 2.5 percentage points, potentially saving 600 billion yuan within five years.

Advertisement

This astronomical debt swap scheme will free up local governments’ fiscal space, enabling them to focus on economic growth and social welfare.