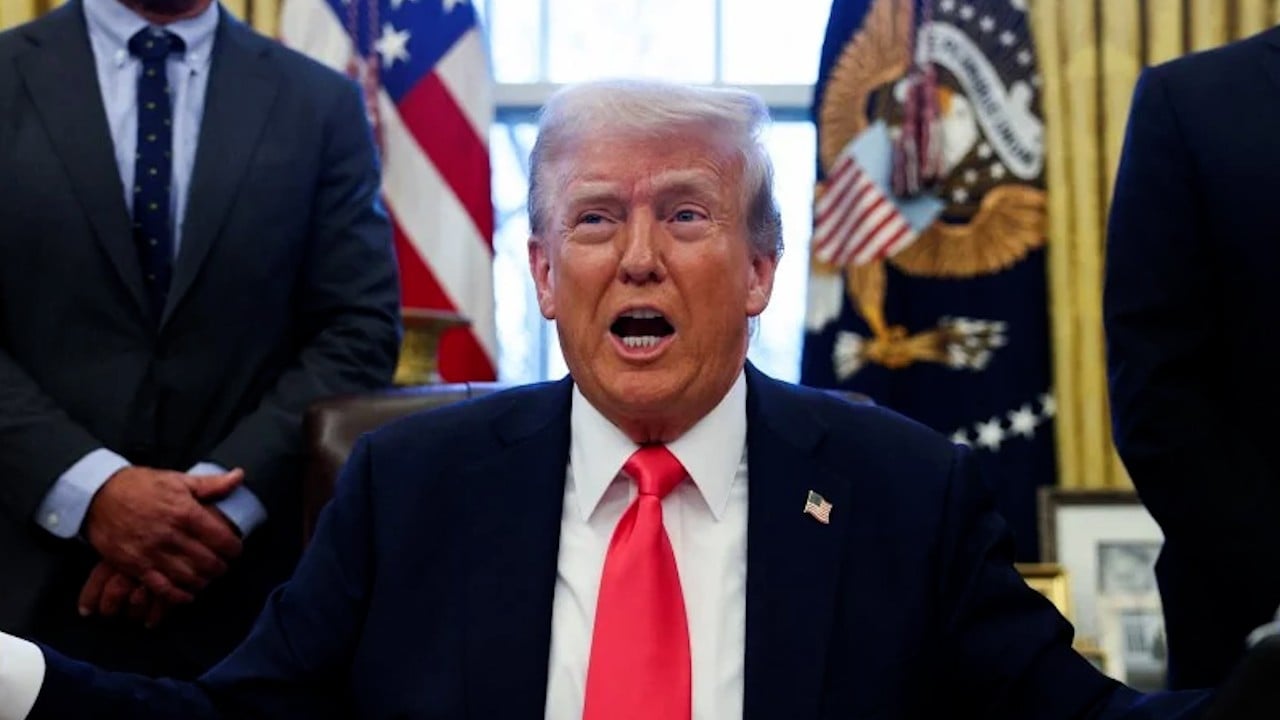

Asian investors have paused from purchasing gold and begun pawning family heirlooms and stashed away holdings to cash in on record-high prices, industry executives say, triggered by US President Donald Trump’s new trade tariffs and swirling geopolitical tensions.

Advertisement

Gold has long been viewed as a safe haven whose value tends to rise in times of uncertainty. Expectations that the US Federal Reserve will slow its cycle of interest rate hikes have added extra shine to the metal, which has historically moved inversely to the dollar.

“We are definitely seeing some opportunistic sellers taking profits off the table and the structured investors like family offices are sitting on the fence and waiting for more clarity where the prices are going to go,” said Padraig Seif, founding partner of Hong Kong-based Precious Metals Asia.

Spot gold prices rose to a record high of US$2,936 an ounce on February 20 and on Thursday were hovering close to that level at US$2,895 an ounce. The metal’s price has risen by around 5 per cent since Trump assumed office in late January, creating uncertainty about whether the rally has peaked, analysts said.

“Is it going to break through the US$3,000 an ounce benchmark or is it going to have a correction downwards after things settle down with Donald Trump and [global] trade?,” Seif speculated.

Advertisement